child tax credit november 2021 late

Be under age 18 at the end of the year. The monthly 2021 Child Tax Credit payments were based on what the IRS knew about you and your family from your 2019 or 2020 tax return.

Missing A Child Tax Credit Payment Learn The Common Problems And How To Fix Them Cnet

Makes the credit fully refundable.

. Ad File a free federal return now to claim your child tax credit. If the modified AGI is above the threshold the credit begins to phase out. Households on low incomes can still claim advance payments until November 15 with another tool which launched in September.

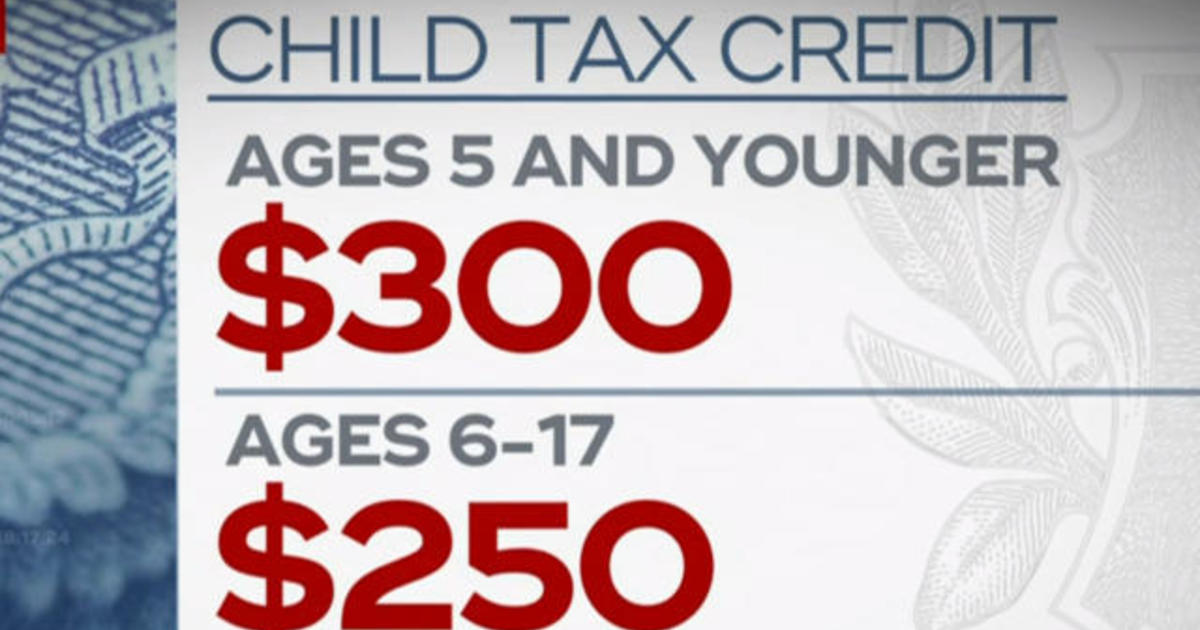

To reconcile advance payments on your 2021 return. Of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300.

722 AM EST November 14 2021. An individuals modified adjusted gross income AGI must be 75000 or under or 150000 if married filing jointly to claim the maximum credit of 3600 for a newborn baby in 2021. It is key to the Bidens administrations effort to.

Get your advance payments total and number of qualifying children in your online account. November 12 2021 1226 PM CBS Pittsburgh. November 15 2021.

Increases the tax credit amount. The 2021 CTC is different than before in 6 key ways. The November advance child tax credit payment comes Monday to millions of Americans.

Even if you dont owe taxes you could get the full CTC refund. To be a qualifying child for the 2021 tax year your dependent generally must. The advance is 50 of your child tax credit with the rest claimed on next years return.

There are a number of changes to the CTC in 2021 because of the American Rescue Plan Act of 2021 which President Biden signed into law on March 11 2021. Enter your information on Schedule 8812 Form. November 11 2021 142 PM 2 min read.

Changes in income filing status the birth or death of a child or having a child move into or out of your household may have affected the amount that you are eligible to receive when you file your 2021 tax. If you qualify for the advance Child Tax Credit you can expect your next payment to hit your bank account by Nov. Some parents may see smaller child tax credit payments for the rest of 2021.

Removes the minimum income requirement. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States.

The IRS has been sending families half of their 2021 child tax credit as monthly payments of 300 per child under. Answer Simple Questions About Your Life And We Do The Rest. The tax credits maximum amount is 3000 per child and 3600 for children under 6.

This caused about 2 of child tax credit recipients to not only get payments late. SOME families who signed up late to child tax credits will receive up to 900 per child this month. Its not too late you can still file your tax return to get the Child Tax Credit and thousands of dollars of additional tax benefits.

CBS Baltimore -- The fifth Child Tax Credit payment from the Internal Revenue Service IRS will be sent this coming Monday. The fifth installment of the advance portion of the Child Tax Credit CTC payment is set to hit bank accounts today November 15. Be your son daughter stepchild eligible foster child brother sister.

The new advance Child Tax Credit is based on your previously filed tax return. If Congress doesnt extend it. The advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November 15.

The enhanced child tax credit which was created as part of the 19 trillion coronavirus relief package in March is in effect only for 2021. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. Its too late to un-enroll from the November payment as the IRS deadline to opt out was on November 1.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. But many parents want. Late registrants and early recipients.

For 2021 the credit phases out in two different steps.

Today S The Last Day To Opt Out Of The December Child Tax Credit Check What To Know Cnet

Irs Parents Of Children Born In 2021 Can Claim Stimulus As Tax Credit Newsnation

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Missing A Child Tax Credit Payment Learn The Common Problems And How To Fix Them Cnet

Who Can I Claim As A Tax Dependent The Turbotax Blog

What Is The Ontario Trillium Benefit 2022 Turbotax Canada Tips

Childctc The Child Tax Credit The White House

Child Tax Credit Schedule 8812 H R Block

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit 2021 Here S When The Fourth Check Will Deposit Cbs News

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How The New Expanded Federal Child Tax Credit Will Work

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit 2021 Here S When The Fourth Check Will Deposit Cbs News

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

What Is The Ontario Trillium Benefit 2022 Turbotax Canada Tips